You receive the email on a Tuesday afternoon. It's from a recruiter in Berlin, or maybe London or New York. The subject line promises "An Exciting Opportunity." You open it, and there it is a salary figure that makes you pause. It’s substantial. It’s life-changing. It whispers promises of a better standard of living, new experiences, and professional advancement on an international stage.

For many Israeli professionals, from tech experts in Herzliya to academics in Jerusalem, this moment represents the pinnacle of career mobility. But seasoned expatriates and financially savvy individuals know a hidden truth: the most important number in that offer letter isn't the one printed in bold. It’s the number that survives the journey from the company’s account to yours, after passing through the complex checkpoint of a foreign tax system.

The geography of your paycheck: More important than your job title

Let’s take a concrete example. You’re offered €95,000 for a position in Berlin. A friend receives an offer for a similar role paying $110,000 in Austin, Texas. On the surface, these seem comparable. But financially, they exist in different universes.

Germany has a progressive income tax (Einkommensteuer), a solidarity surcharge, and church tax (if applicable). Texas has no state income tax. Your friend in Austin will keep significantly more of their gross salary than you will in Berlin, even if the numbers appear similar at first glance. This is the single most overlooked factor in international job negotiations.

This is where moving beyond guesswork becomes crucial. A generic online estimator that applies a flat "foreign tax rate" is worse than useless. It's misleading. You need a global salary calculator built with granular understanding of specific national and even municipal tax codes. Does the role require you to live within New York City limits, triggering its additional income tax? Will you be subject to the UK’s National Insurance contributions? These details aren't footnotes; they are the primary factors determining your actual disposable income.

Busting the "Tax Bracket" fallacy

A common fear prevents many from pursuing higher salaries abroad: "If I earn more, I'll move into a higher tax bracket and actually take home less money." This myth persists across languages and borders, but it's mathematically false in countries with progressive tax systems (which includes most developed nations). Only the portion of your income above a threshold is taxed at the higher rate.

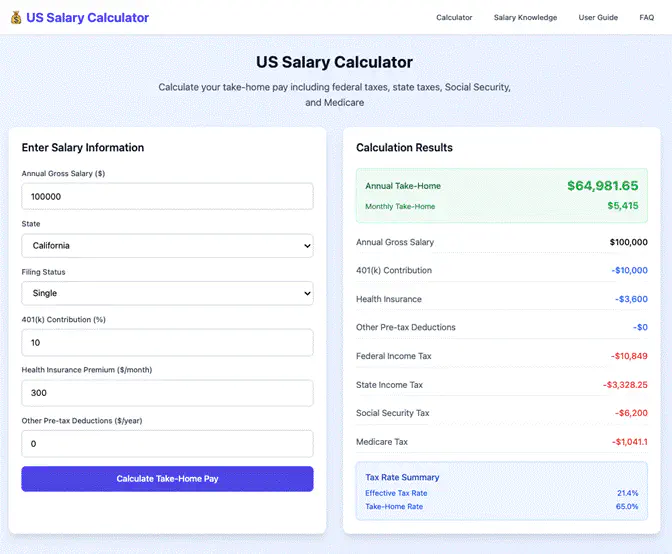

Earning more always results in keeping more. A proper salary tool should prove this to you visually. A reliable net salary calculator USA, for instance, won’t just give you a final number. It will show you a transparent breakdown: this much to federal tax, this much to Social Security, this much to California state tax. It replaces anxiety with clarity, showing you that a raise or a lucrative overseas offer is exactly what it seems a financial upgrade.

The family decision: From abstract numbers to real-life budgets

For professionals with families, this calculation transforms from personal finance into a foundational life decision. That overseas salary must fund not just your career, but your children's international schooling, your spouse's potential career pause, housing in an expensive new city, and the overall cost of living.

- Negotiate based on reality, not fantasy: Armed with accurate net-income calculations, you can shift the conversation. Instead of "I want more," you can say, "Based on the cost of living in Dublin and the after-tax income from this offer, my family would need a net amount of X to maintain our standard of living. To achieve that, the gross salary would need to be Y." This is the language of serious professionals.

- Compare the Incomparable: How does a package in Singapore, with its lower income tax but extremely high housing costs, truly compare to an offer in Tel Aviv with different social benefits? Only by calculating net disposable income after all major deductions and essential costs can you make a rational choice.

- Plan for the true cost of transition: An international move has hidden financial burdens: visa costs, shipping, temporary housing, and potential double taxation during the transition year. Knowing your precise monthly net income in the new country allows you to build a bulletproof savings plan before you go.

Your financial compass for a borderless career

In an era where talent is global, your financial understanding must be too. A sophisticated salary platform acts as your compass, translating the promise of international opportunities into the concrete reality of monthly budgets.

The bold figure in the offer letter is the dream. The net salary, calculated with precision, is the reality upon which you will build your daily life. Before you make a decision that will reshape your career and your family's future, do the most important math of all. Understand exactly what you'll keep, not just what you'll earn. That knowledge is the true foundation of any successful international adventure.