Billions of dollars generated from the Leviathan and sister natural gas fields sales are beginning to flow into Israel’s coffers. What is the plan for spending the transformative treasure? “Show me the money” before it is swallowed by the politicians and siphoned off by the oligarchy.

I have some suggestions.

Israel’s power elite is already feasting on our nation’s natural resources.

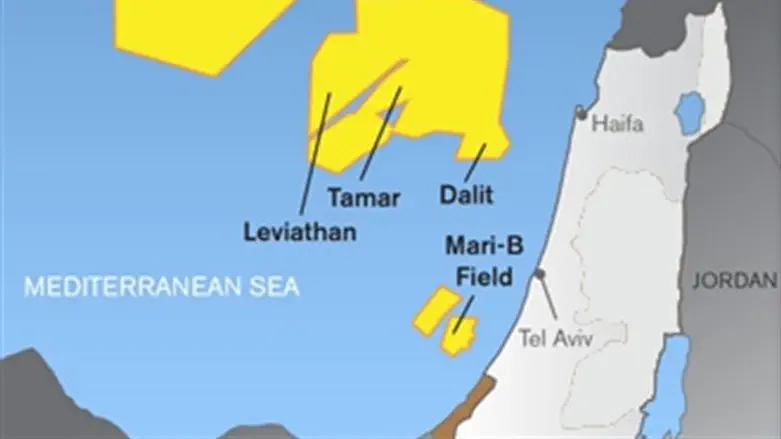

Houston-based Noble Energy and partner, Tel Aviv’s insider-controlled Delek Group, project Leviathan gas sales and profits to be “the biggest exploration success in its history.”

Here’s what the powerful are slobbering over.

- The Israel Electric Corporation secretly passed on $1.3B in compensation from a gas sale to Egypt. The revenues and profits allegedly ended into Delek and Noble accounts in exchange for nothing made public. The utility buying consumers got no money or relief.

- The bulk of Leviathan gas is for export not domestic use. It is initially going to Egypt, Cyprus, Jordan, and Greece. A pipeline is planned to sell natural gas in Europe. The government doesn’t talk about showing us the money.

- Liquefied Natural Gas will be shipped by seagoing vessels to Asia. Show me the money.

- Gas sales to Egypt are estimated to be worth $15B over ten years. Another deal is said to reach $7.5B. Where is the money?

- Revenue over 15 years from gas contracted for sale to Jordan is worth $500M. Where’s the check?

Israel established the Israeli Citizens’ Fund in 2014. It is known in finance as a sovereign wealth fund. But it is empty. A Globes, December 4, 2019, headline says it all, “Israel’s sovereign wealth fund: No money, no management.”

Israel is beset by a stalled government. An intimidated bureaucracy with a rare whistleblower. A Knesset neither humbled nor shamed by a slew of investigations and indictments of Ministers, their quest for personal immunity from prosecution for fraud and bribery, is the bane of existence for equitable distribution of gas-sourced revenues and profits.

Israel ought to learn from the Dutch and Alaska. They enjoyed their new found wealth from commodity natural resources. Things went horribly wrong for the Dutch but Alaskans are thriving. In 1977, Dutch new-found natural gas exports soared. Unemployment also soared five-fold. Gas extraction is not labor-intensive limiting job creation. Corporate investment tumbled. Foreign demand for Dutch currency made it too strong shaving the competitiveness for Dutch products in international markets. Israel’s economy eight decades later is not too dissimilar from “Dutch disease” as the Economist coined the condition.

Israel’s economy is now trailing that of other developed countries. Private capital investment is falling. Productivity lags. Foreign corporate investment represents, according to the Israel Advanced Technology Industries, GKH Law and IVC Research Center, the “backbone” (18%) of direct taxation in Israel. Israel’s organic growth is the slowest in four years. Israel’s budget deficit is set at 3.7%, excessively greater than the 2.9% the government targeted. The shekel is bounding ahead of the dollar and pound, so the exchange rate suffers and the cost of living is rising fast.

Yet eligible residents of Alaska get direct benefits since their government established two sovereign wealth funds to manage the largesse from the oil and gas industry since 1982. The Alaska Oil and Gas Association reports on one benefit, “In 2018, every qualified Alaskan received a dividend of $1,600.”

Here are some suggestions about what Israel might do with the money.

- Give it back in dividends to the people. Cut the oppressive taxes. The economy will soar. Lower the high cost of living in Israel driving olim back home and citizens to live and work overseas. Send eligible residents a dividend check from the gas sales

- Improve sustainability programs. Kudos to the Israel Electric Corporation that signed a $700M contract to buy natural gas over two years from the Leviathan site. IEC is switching away from polluting coal. Now, lower electricity rates. That act will translate to more cash in consumers’ pockets and never underestimate an Israeli to spend money in their pockets. Retailers, food producers and manufacturers will have more money too, and create more jobs.

- Connect consumers to the gas distribution network, as the State Controller warned in 2017.

- Replace electric-powered water heaters. Goodbye to the notorious roof top Dood. Give tax credits and free loans for installing natural gas hot water boilers in every building. The need to conserve freshwater is critical according to the Ministry of National Infrastructure, Energy and Water. There is no time or water to waste.

My plumber, Ashley Coleman, tells us the standard roof hot water heater (dood in Hebrew) gives 150 liters of hot water. That is 25 minutes of showering time per dood-full, not accounting for my teenage granddaughters. It takes about two hours of electricity to heat a dood-full of water in the sun-diminished winter. Even in the summer the solar systems only save five-percent of electricity. Israelis notoriously forget to turn-off the dood switch wasting hours of electricity.

Gas-fired hot water boilers heat water fast and automatically turn-off with a thermostat. Moreover, a resident must let gallons of potable, cold, water run-off down the drain from the roof top dood until the hot water hits. This infrastructure is from pioneer days and its planned continuation seems ridiculous in an age of high tech and bountiful pools of natural gas.

The natural gas finds and mining are Israel’s Hallelujah moment. Instead of allowing those who have plenty to have more, give back to those who have little and find their money always being taken away.

The author is manager of an investment fund, university teacher, business consultant, speaker and writer. He can be reached at Harold.goldmeier@gmail.com.