SEC stands for the United States Securities and Exchange Commission. They are the US government watchdog of American corporate finance. If a corporate body knowingly fails to disclose a risk that the SEC believes its corporate executives knew should have been disclosed to shareholders or bondholders, they along with the DOJ can put the executives and their attortneys into jail.

In short, any stock or bond to be sold or traded on an American exchange needs to satisfy the SEC’s financial risk disclosure requirements, or face civil or criminal jeopardy.

How are the SEC disclosure requirements relevant to Israel’s safety and security? Saudi Arabia is about to bring to market its 2 Trillion Dollar initial public offering (IPO). And, if one simply looks at the Middle East, one quickly understands that Saudi Arabia’s and ARAMCO’s security relies solely on the safety and security of Israel.

Without Israel, Saudi Arabia and ARAMCO are finished, and using Mr. Hinman’s analysis, if a corporation must disclose something as ephemeral as a financial risk from BREXIT, then surely Saudi’s ARAMCO IPO must disclose the catastrophic risk if Israel is at risk.

To first understand what risks need to be disclosed, Mr. Hinman makes it very clear. Citing the classic case of TSC Industries, Inc. v. Northway, Inc., 426 U.S. 438 (1976), Mr. Hinman stated that “Our [the SEC’s] disclosure regime emphasizes materiality. Information is material if there is a substantial likelihood that a reasonable investor would consider it important in deciding how to vote or make an investment decision.”

So, the question devolves to: Is the risk facing Israel “material” to the Saudi 2 Trillion dollar ARAMCO IPO? Or, put another way, is there a substantial likelihood that a reasonable investor would consider it important to know before buying ARAMCO IPO shares that without a strong Israel, their investment in ARAMCO will catastrophically go up in a ball of flames?

As even the left-wing Abba Eban said, the 1967 borders for Israel are “Auschwitz Borders,” meaning if Israel is pushed to the 1967 borders it could be annihilated. Given there exists a high probability that there will be many attempts to push Israel to its 1967 Auschwitz borders in the next 5 years, any ARAMCO IPO must deal with the probability of the risk entailed.

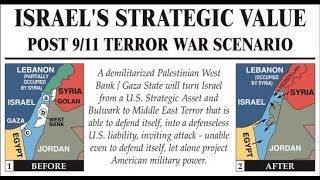

Why does Israel’s security undergird Saudi Arabia’s and ARAMCO’s security? It’s simple - just look at a Middle East map and ask yourself what would happen to the Middle East, and more particularly Saudi Arabia and the Gulf States, if Israel were to be weakened.

The first losers would be the Palestinian Arabs who now live within the Green Line and in Judea and Samaria. Instead of being protected from being raped and pillaged by Iran or Egypt, the Palestinian Arabs now get health care and an education. If there were no Israel,, there would be no Palestinian Arab State but a bigger Egypt in the South, and a bigger Iran/Syria/Hezbollah in the North.The fiction of the need of a “Palestinian State” would forever disappear as even a minor world issue. The only reason that anybody cares about a Palestinian Arab State is for its use against Israel. (Except for the messianic Israeli and American useful idiot leftist Jews who think that a Palestinian State would help Israel become a “Jewish State.”)

In that case, who is going to protect King Abdullah of Jordan and his teetering Hashemite kingdom? Israel has been protecting Jordan from Syria for over 50 years. Without Israel, King Abdullah and his kingdom are road kill.

For 30 years, I’ve stressed these simple steps:

1) Without a strong Israel: No Palestine, instead Egypt/Iran occupation

2) Without a strong Israel: Jordan disappears, (and for 30 years every person has said: Absolutely, no question!)

Which brings us to the third and final step:

3) Without a strong Israel, Saudi Arabia has two new northern neighbors:

- Egypt - the 100 million Sunni Arab populated country that is desperately poor with the greatest conventional army in the Middle East and control of the Suez Canal, and

- Iran- the 80 million Shiite populated country that is bent on establishing a Shiite Terrorist Imanate throughout the entire world.

With those two neighbors, Saudi Arabia and its ARAMCO would be gone in no time flat. How could America even deploy forces through the Suez Canal and defend Saudi Arabia if Egypt controls the Suez and is devouring Saudi Arabia?

Or, put into SEC lingo; the risk facing Israel is extremely material information as to whether a reasonable investor would consider buying ARAMCO IPO shares. Therefore, any Saudi ARAMCO IPO must disclose to its potential buyers that their ownership of ARAMCO shares relies on ensuring the safety and security of the State of Israel.

Now one can better understand why recently the Arab gulf monarchies have taken a liking to Israel’s existence. It’s for a very simple reason, they know that if not for Israel, their heads would be relieved from their shoulders.